How Flood Rescue Reduced Payment Delays by 72% and Saved 29 Hours Weekly with Automation

Flood Rescue, a company specializing in water and fire damage restoration services, faced significant delays in receiving payments, particularly from insurance companies. With a small accounts receivable team and a manual, time-consuming process for managing overdue invoices, their cash flow was under constant pressure. The AR team spent countless hours manually tracking payments, which hindered their ability to focus on growing the business.

Stephanie Phillips

Flood Rescue

Key Results with AR Workflow

72% reduction in payment delays

Flood Rescue decreased average payment delays from over 100 days to less than 28 days, greatly improving their cash flow.

29 hours saved weekly

(over 14 days per month)

Automating the follow-up process freed up 29 hours each week, allowing the AR team to focus on more strategic tasks.

65% average open rate on collection emails

Automated follow-ups saw a 65% open rate, leading to faster client responses and fewer overdue payments.

Flood Rescue

Employees

26

AR Team

2

The Challenge

Flood Rescue was struggling with lengthy payment delays, with some invoices remaining unpaid for over 100 days. These delays caused significant cash flow problems, making it difficult to cover daily expenses and invest in growth. The AR team’s manual process for tracking overdue invoices, using spreadsheets and emails, was inefficient and time-consuming. Without a centralized system for managing follow-ups, invoices were often overlooked, and payment timelines were extended unnecessarily.

We were spending too much time chasing overdue invoices, which took valuable time away from growing the business.

- Owner, Stephanie Phillips

Why They Chose AR Workflow

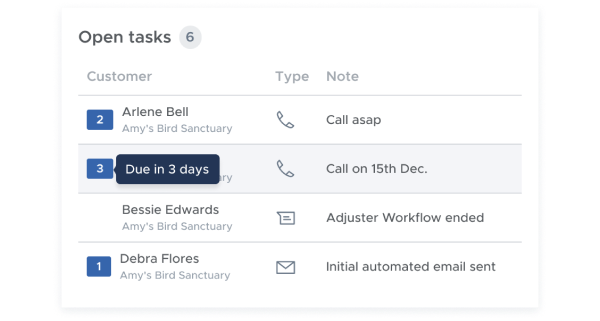

Flood Rescue chose AR Workflow to automate their accounts receivable process, streamline operations, and reduce manual efforts. AR Workflow’s features that stood out for Flood Rescue included:

-

Automated payment reminders: To drastically cut down on the time spent manually following up with clients.

-

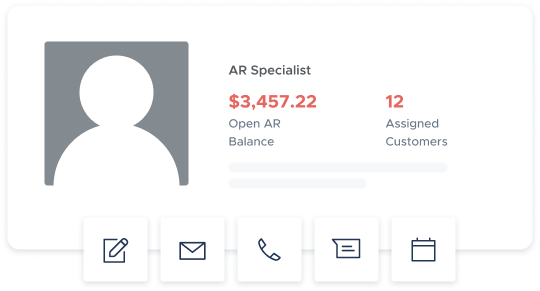

Real-time tracking: A centralized dashboard that provided visibility into the payment pipeline and overdue invoices.

-

Client portal: A self-service platform allowing clients to easily access and pay invoices, simplifying the process for both parties.

AR Workflow has drastically reduced the time we spend managing overdue invoices. We’re getting paid faster and can now focus on scaling our business instead of chasing payments.

- Owner, Stephanie Phillips

Implementation Process

Flood Rescue's implementation of AR Workflow was fast and smooth, with the system fully operational in under a week. The following steps were part of the setup:

-

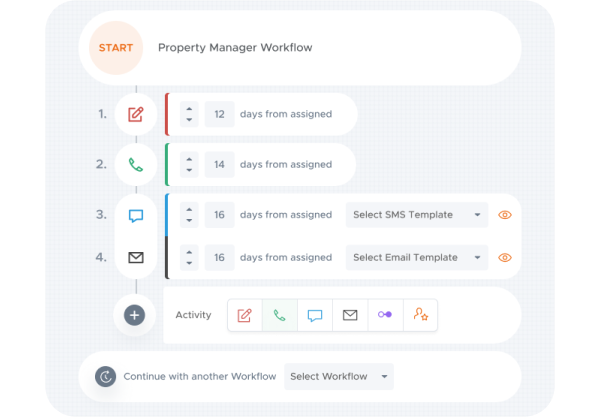

Automated follow-ups: Payment reminders were automated through email and SMS, ensuring that clients received timely reminders without manual input.

-

Real-time dashboard: The AR team could now monitor all outstanding invoices, payment statuses, and follow-up actions in a single, centralized system.

-

Client portal: Flood Rescue’s clients were given access to a self-service portal, making it easier for them to view and pay invoices, leading to quicker payments.

The implementation process was seamless. Within days, we were already seeing improvements in our payment timelines, and our workflow became much more efficient.

- Owner, Stephanie Phillips

Results After 45 Days

Just 45 days after adopting AR Workflow, Flood Rescue experienced dramatic improvements in both their accounts receivable process and overall efficiency:

-

72% reduction in payment delays: The average payment delay dropped from over 100 days to less than 28 days, significantly improving cash flow.

-

29 hours saved per week (over 14 days per month): Automating follow-ups saved the AR team 29 hours each week, which they could now dedicate to more value-driven activities.

-

65% average open rate on collection emails: Automated reminders had a high open rate, leading to faster payments and fewer overdue invoices.

-

Improved client experience: The client portal made it easy for clients to view and pay invoices, reducing disputes and delays.

AR Workflow has drastically reduced the time we spend managing overdue invoices. We’re getting paid faster and can now focus on scaling our business instead of chasing payments.

- Owner, Stephanie Phillips

Start Collecting Payments Faster

Like Flood Rescue

Just connect your QuickBooks account and start freeing up your time, your team’s time and your cashflow immediately.

-

Increase profits by 5-10%

-

Free 1-on-1 training for your team

-

14-day free trial, cancel any time

No credit card required